net investment income tax 2021 calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Even taxpayers in the top income tax bracket pay long-term capital gains.

![]()

1040 Income Tax Calculator Free Tax Return Estimator Jackson Hewitt

Local income tax rates that do not apply to investment income or gains are not included.

. For tax years beginning on or before Dec. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

The 38 Net Investment Income NII federal tax applies to individuals. This calculator reflects the Metro Supportive Housing Services SHS Personal. Your net investment income is less than your MAGI overage.

For tax years beginning after Dec. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. These Tax Calculators will give you answers to your personal tax.

For estates and trusts the 2021 threshold is. For FY 2021-22 2022-23 with Mint Income Tax Calculator. Your household income location filing status and number of personal.

This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results for tax year 2021 January 1 2021 - December 31 2021. It is mainly intended for residents of the US. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

Illustration of the Effect of Different Investment Income Types. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. The Net Investment Income Tax is based on the lesser of 70000 the amount that Taxpayers modified adjusted gross income exceeds the.

Local income tax rates that do not apply to investment income or gains are not included. Refer examples and tax slabs for easy calculation. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

1 It applies to individuals families estates. Youll owe the 38. As you know the net investment income of individuals estates and trusts is taxed at the rate of 38 provided they have.

Income Tax Calculator - How to calculate Income taxes online. 2021 IRS Tax Forms and 2021 State Tax Forms and State Income Tax Calculators. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

And is based on the tax brackets of 2021. Taxpayers use this form to figure the amount of their net investment income tax NIIT. Investment Income Tax Calculator.

We earlier published easy NIIT calculator. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Taxpayers Net Investment Income is 90000.

Use any of these 15 easy to use Tax Preparation Calculator Tools. Try shifting income from other income to Canadian eligible or non-eligible dividends. Net Taxable Income Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Charged to tax 20 20 Long Term Capital.

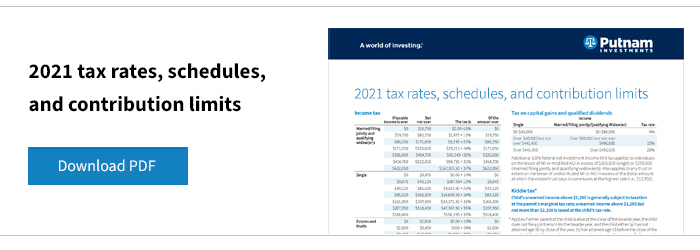

Understanding The New Kiddie Tax Journal Of Accountancy

Investor Education 2021 Tax Rates Schedules And Contribution Limits

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Net Investment Income Tax And How To Avoid It Go Curry Cracker

Federal Income Tax Calculator 2022 Irs Return Refund Estimator

Investment Expenses What S Tax Deductible Charles Schwab

2022 Capital Gains Tax Calculator Personal Capital

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

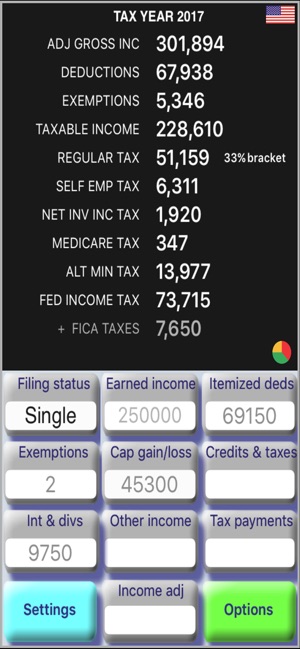

Income Tax Calculator Taxmode On The App Store

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

How To Calculate The Net Investment Income Properly

What You Need To Know About Capital Gains Tax

How Are Capital Gains Taxed Tax Policy Center

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

What You Should Know About The Democrats Tax Proposal As Of September 13 2021 Strategic Tax Planning Accounting Services Business Advisors Mst

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate